Can a Wife or Husband draw from the other's Social Security benefits?

Yes. Let's look at a few different situations. Note that we have no intent to be sexist but to make these examples clear, we have assumed that the husband has earned more than the wife.

Wife has never worked with example

Your current wife cannot receive the husband's benefits until the husband files for retirement benefits. Remember that if you have not reached your full retirement age, your benefits are reduced. Here is the table showing reductions if you have not reached your full retirement age.

Example:

Mary has never worked. Her husband John has worked continuously and has always earned the maximum salary subject to social security taxes. His benefit at full retirement age is $20,000 (a hypothetical number for this example). John was born in 1949 and his full retirement age is age 66. John and Mary are both currently 62. If John starts his benefits now, he will not receive $20,000 annually. He will receive a reduced benefit for taking early SS. He will not get $20,000, he will get 25% less, or $15,000 annually. But if he starts his benefits now, Mary can also get benefits now per the schedule below. She would get $7,000 annually ($20,000 x 35%).

Most people think that they get the largest payment automatically. Not true. You need to make choices when you apply and if you make the incorrect choice, you get a smaller check -- for life. Even if you already receive Social Security Benefits, you may be able to change your selections.

• If full retirement age is 65, a spouse can get 37.5 percent of the worker's unreduced benefit at age 62;

• If full retirement age is 66, a spouse can get 35 percent of the worker's unreduced benefit at age 62;

• If full retirement age is 67, a spouse can get 32.5 percent of the worker's unreduced benefit at age 62.

Wife has never worked, is older than Husband

Same example as above except that Mary is 66 and John is 62. John files for Social Security and so does Mary. John gets a reduced benefit of $15,000. Mary will get 50% of John's FULL benefit as she has reached full retirement age. She will get $10,000 (50% of $20,000) annually.

Both Husband and Wife have worked with example

Same situation as above except that Mary has worked. Based on her earnings, her benefit at full retirement age is $8,000 (a hypothetical number for this example). In this case, the couple can do the following:

a) Mary starts her benefits at age 62 and receives $6,000 annually ($8,000 less 25% for starting benefits early). John does not start his benefits.

OR

b) Mary starts her benefits and age 62 and so does John. Mary gets the higher of her own benefit ($6,000) or her spousal benefit (35%$7,000). John, the husband, gets $15,000.

Note that the wife's benefits will not decrease the husband's benefit. In fact, the value of the benefits the wife receives, added to the husband's benefits, may help the husband decide if taking benefits early might be beneficial. In this case, we see that by taking benefits early, John gives up $5,000 annually but doing so enables Mary to get $7,000 annually.

Both Husband and Wife has worked with example, Wife is Older

Same situation as above except that Mary is 66 (her full retirement age) and John is 62. Based on her earnings, her benefit at full retirement age is $8,000 (a hypothetical number for this example). In this case, if John files for Social Security, he gets $15,000 annually. Mary, because she has reached full retirement age, will get half of his FULL benefit and will get $10,000 annually (50% x $20,000) as it is higher than her benefit ($8,000).

In future posts, we will cover additional examples of ways that husband and wife can maximize social security benefits. This other post covers how to pay less social security tax on your benefits.

//

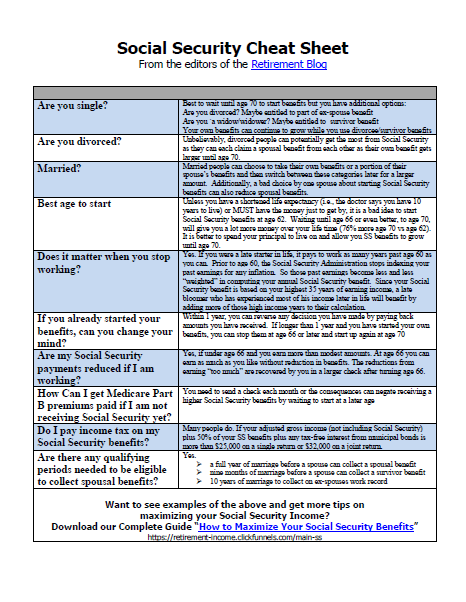

Maximize Your Social Security Income

Get the one-page social security Cheat Sheet

You may think that the folks at the Social Security office will tell you how to get the biggest monthly check. In fact, the federal rules PREVENT them from advising you. There are millions of people who have given up more than $50,000 just by making a simple yet incorrect method of taking their Social Security benefits. Don’t let that be you! Get your free copy now.

Great examples, these are the most common questions on Social Security benefits. Each and one of us can somehow relate to your blog posts. Keep it up!

Thank you for making this confusing subject more clear. But what happens if the woman is older, never worked, and her husband dies before he applies for SS?

When do you think is the best age to start getting payment from Social Security?

Very informative article. I thought it was interesting that the wife who never worked was still entitled to some her husband's benefits.

Very well explained and this is great for the readers who wants to know more about the social security benefits.

Thanks for elaborating it, I don't have any idea about it at first. At least, I have a little background now.

typical to assume the man makes more than the woman, lol.

Social Security is an important topic that not many people are well informed about. Thanks for doing your part in educating americans.

Really this blog is very beneficial for social security, it's important thing, and i think everybody should be loyal for social security.

i am 75 my wife is 70,upon my death will my wife be able to recieve some of my benifits?i recie3ve 1`500 she gets 677 thank you iun advance

I would like to see an example of a husband and wife that are both 66 and both are still working full time, please!

After April of this year, the ability for either spouse to tap into the Social Security account of the other is significantly diminished (unless you made a file-and-suspend election prior to May). At this point, one spouse can get 50% of the other spouse's benefit IF it is less than their own benefit. To do that, both spouses must be taking their benefits. Otherwise, the best course is to both wait as long as financially possible to start benefits as your benefit increases each year you wait. There are other factors to consider such as tax bracket and health.

Please clarify about us. My wife is 70 and I am 75. Her SS income is far less than half of my SS income. Is she supposed to receive as much as half of my SS income instead of her own SS income and that will NOT affect my SS income. In this scenario, she receives approx 8000 a year after medicare deduction and I receive approx. 26400 a year after medicare deduction. If that is true, what are we supposed to do something about that? Thank you

she should be able to fix the way she filed for ss to get half of your benefit

you need to get down to SS office

i have a small business, i am 68 my wife is 6 yrs. younger, i file a schedule c under my social security number, i have postponed receiving benefits with the ssa. can i switch to my wifes ss# to qualify her for benefits on her own account - which is 4 credits short? will this damage the amount i receive?

Best recommendation is to use this inexpensive software to get a precise answer

https://maximizemysocialsecurity.com/

you really need to enter both you and your wife's benefit info into the software (get the benefit info from the social security webs site

https://secure.ssa.gov/RIL/SiView.action

my mom is 76 my step dad is 67. she took early reirement due to health issues and he retired at 67. can she get more for her social security now that he is retired? she only gets under 200 month. who can live on that.

wife can get 50% of spouses social security benefit once the husband starts taking his benefits

Husband took social security at age 62-current annual social security earnings are $18,700. Wife took social security at age 62 - current annual social security earnings are $15,900. At husband's passing, how much would wife's social security earnings be increased?

wife gets the husband's social security benefits at his passing, assuming it is higher than her own