Leave it to Congress to make things more complex than necessary. The only thing simple is that the same tax rate applies to capital gains and dividends as it has in the last several years.

Most people doing a quick read of new tax rates think that rates on dividends and capital gains have increased from 15% to 20%. But that is only part of the story. Here is the full story on how these tax rates work as of January 1, 2013 (summarized in the table below).

Tax Break For Seniors

First, those taxpayers whose taxable income would provide them a tax bracket of 15% or less (for single people, taxable income of $36,250 or less, for married people filing jointly $72,500 or less), the tax rate on capital gains and dividends is zero. This is very good for retirees as typically, they are in the lower income brackets and get a larger percentage of their income from dividends and capital gains. Before selling any asset that would generate a capital gain, retirees should first calculate that the sale will not have them exceed the taxable incomes above. If the sale would do so, it will be better to make the sale in portions (e.g. 200 shares of stock this year, 200 shares next year, and so on) so as to always keep their taxable income below the level that would expose them to a 15% tax on capital gains.

Same 15% Rate for Most Others, BUT....

For everyone else, the tax rate on capital gains and dividends is 15%, except for individuals with adjusted gross income (AGI) above $200,000 and married couples filing a joint return with more than $250,000 AGI. These people will pay up to an additional 3.8% of their net investment income (dividends and capital gains included in this bucket). They may not need to pay the full 3.8% because the amount on which the 3.8% is levied is limited to the excess of AGI over the $200,000 (singles) or $250,000 (married). In other words, they pay the 15% basic tax rate on capital gains and dividends plus a potential add-on of 3.8% for a total of 18.8%.

The Wealthy Pay 20%

And last, for people with taxable income exceeding $400,000 (single) or $450,000 (married), the base tax rate on capital gains and dividends is 20% (instead of 0% or 15% as it is for others). But if you add the extra 3.8% in the above paragraph which will apply to these folks (except for very exceptional circumstances), their capital gains and dividend tax rate in 2013 is 23.8%.

Note the the rate is as convoluted as ever because at some income levels, the rate is based on taxable income. But for people in the $200,000 to $400,000 adjusted gross income group (singles) and $250,000 to $450,000 (married) the rate is mostly based on their tax bracket (i.e. taxable income) but the 3.8% potential levy is a function of adjusted gross income.

This all sounds like a very good structure for tax preparers and makers of tax preparation software.

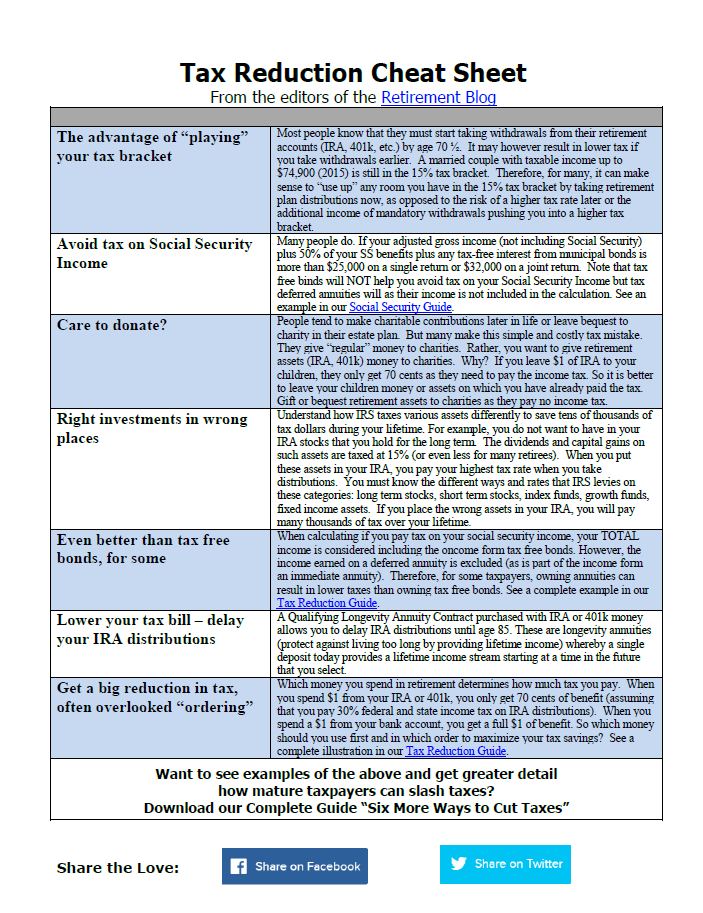

Here is the summary table of tax rates on dividends and capital gains:

2013 Table of Tax Rates on Dividends and Capital Gains

|

Taxable income - single

|

Taxable income - Married

|

Potential Surtax on Capital Gains and Dividends

|

Tax Rate on Capital Gains and Dividends

|

| Up to $36,250 | Up to $72,500 | 0% | |

| From $36,251 to $400,000 | From $72,501 to $450,000 | 3.8% for singles with AGI above $200,000 and for married couples filing a joint return with more than $250,000 AGI, limited by the amount AGI exceeds these amounts |

15% |

| Over $400,000 | Over $450,000 | 20% |

You Pay More Taxes Than Necessary

And we guarantee your CPA has never told you The problem with paying taxes is that most people overpay. So if you are concerned about having enough in retirement, you must stop overpaying taxes. I know you think your CPA takes care of this for you. WRONG. I AM a CPA (retired) and I can tell you that 90% of CPAs do nothing more than enter your information into the little boxes on the tax return but NEVER tell you how to pay less next year. Why? Many of them simply do not know what we can show you. In ten minutes.Get Your Copy Now - 6 Ways to Cut Retirement Taxes

well this is certainly great for middle class

Does Washington ever make things easier? This time with a little bit of reading they actually have. Thanks for sharing with us. I'll pass this on to my folks.

this article is great and has it's nice scripts

Good article, but to be honest, I feel sorry for the younger generation

thank you for the information and opinions you wish with this opinion could be better understood anymore.!!

This is great information and will be valuable to a lot of my clients. Thanks.

I have a question. My parents have a mortgage on a rental property (homestead) sister is/was renting. They are looking to sell it. They bring in approximately 26000 a year, as my mother is no longer working. What would the capital gain ramifications be on this property would they qualify for the 0% tax??

depends on the size of the gain