Today, many couples both work. They may plan to retire together, but sometimes unexpected layoffs force one spouse out of a job at a retirement age earlier than expected. If he's the higher earner, lack of fulltime job prospects can force him into permanent retirement. What should the couple do to generate sufficient retirement income?

Adapt to a Pre-retirement Strategy

If you can't find a good paying full time job prior to your planned retirement age, then you and your spouse have to begin adapting to lower income and revised planning for when to take retirement benefits from retirement pensions and social security.

Tighten up living expenses now to adapt to one income if possible. The unemployed spouse may consider some part-time work to help bolster household income, and wean himself - and the couple -into a retirement income mode. It may be an opportunity to begin a hobby that can produce some income now and as additional retirement income.

Coordinate Retirement Pension and Social Security Benefits

If he has a retirement pension, he may choose the higher paying single life pension payout rather than the joint-life payout. That can give some extra needed monthly income. To protect the other spouse, he should buy a term life insurance to cover the younger spouse if he dies early.

If possible, see if the higher earning laid-off spouse can hold off beginning his Social Security benefits - at least until his full retirement age. Beginning social security retirement benefits at less than "full retirement age" (commonly 66, depending on year of birth) will reduce his payments - and those to his wife - permanently. That's because the other spouse is entitled to receive her own benefits or 50% of her husband's - whichever is higher. If he dies first, she then has a right to take the full benefits her husband was getting.

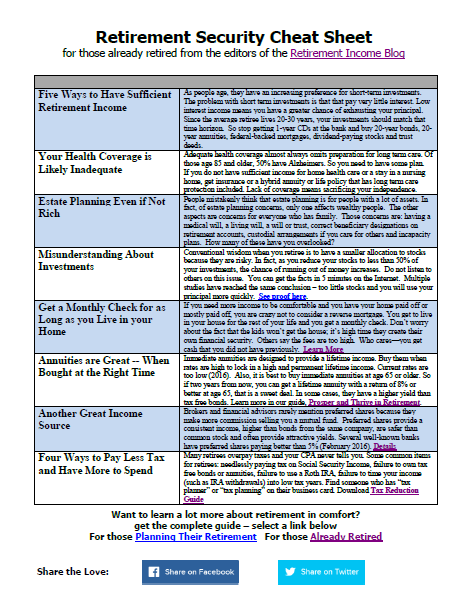

Seek a health benefit plan to protect retirement savings

Try to get the laid-off spouse on health insurance to forego the possibility of serious illness or accident that can cut deep into retirement savings. Since Medicare doesn't start until your 65, you should see if he can be added to the company insurance plan of the employed spouse.

Alternatively, COBRA allows you to maintain your company policy for up to 18 months. Lastly, you may have to apply for private insurance which can cost up to $1,000 a month for an individual policy.

Develop a winning attitude

Look to using the forced early retirement as an opportunity to ease into retirement mode. Don't spend too long looking for that high paying full time job - while spending as usual.

Begin your retirement mode of living and work at what you always had a desire to do. It'll keep your spirits up and possibly create an ideal "retirement" career that leaves you and you spouse ultimately better off.

Leave a Reply