Guest Post by David Bressler.

David Bressler is author of the forthcoming book "The Elephant in the Room has a Paycheck", a fun & socially conscious blueprint for successful long-term investing.

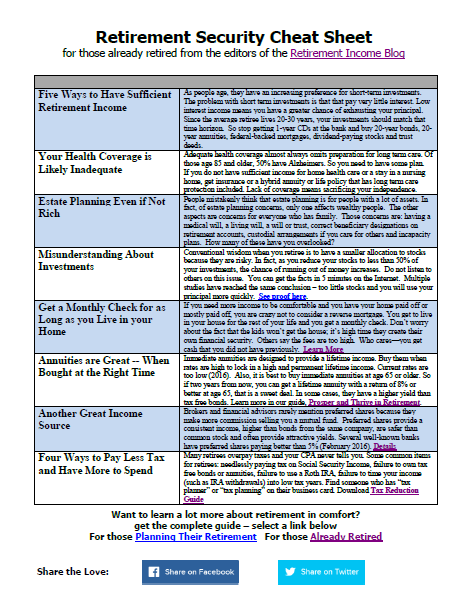

Everyone is always so concerned with being careful to avoid absolutes when it comes to future expectations, that when discussing the value of dividends and their potential for retirement income we are missing a great opportunity to increase retirement income and security.

"Future dividends are not guaranteed."

This is a truth, but does not tell the whole story.

The decision to pay a dividend, and how much to pay, is not a day-to-day decision (or even a year-to-year decision). Dividends are a "very high level corporate strategy", and unlike stock prices are determined by executives (and committees) not by the 'free market'.

But, it's not the dividend itself that's most important.

It's the dividend raise that’s the secret ingredient.

Dividend Raises

There's an exclusive set of dividend payers that have both paid consecutive dividends for a long time AND increased the amount paid each-and-every year for decades. These companies are called dividend aristocrats and have raised their dividends for a minimum of 25 consecutive years. PG for example, is currently celebrating their 57th year of consecutive increases.

Beating Inflation

The challenge with a CD or Fixed Income based strategy is inflation. And, I’m not thinking about how the government measures inflation either. I'm talking about the "real inflation experience". I'm in NYC, and they're talking about another subway fare hike. That's a 10% increase at a minimum. And, even if we get an increase like that every 2 years, it's still way higher than the government's reported inflation rate. Want to eat healthy? Inflation stats don't factor in the reduced quality of the food they do measure. So your prices are going up if you want to eat at the same level of health as in the past. And, so on.

As dividends are raised year-after-year there is a possibility to beat inflation. For example, on their investor website ExxonMobil mentions that they have raised their dividend 6% a year, on average, for the past 30 years (click to enlarge table).

It's not just about inflation risk though.

A Realistic Risk Perspective

There's a quote I like to remember when it comes to risk:

"In theory there is no difference between theory and practice. But, in practice, there is."

There are a few ways that dividend aristocrats reduce practical risk, though it might not be theoretically true.

- In terms of cutting the dividend: The CEO of a company that has a 25+ year streak of dividend raises doesn't want to be "the guy" who breaks that streak. It's an ego and job-security thing at a very personal level of motivation.

- In order to keep the streak going, a company might put a small increase in place. Maybe small increases are a leading indicator for trouble?

- Before cutting the dividend, they'd stop the increases. The company is less likely to cancel the dividend after increasing it for so many years. The first thing they'd do in a "bad" situation would be to not-increase the dividend. Again, missing an increase one year is a sell-signal for someone depending on dividend raises.

To recap, dividend aristocrats help protect against inflation risk and provide investors with a selection of companies whose dividends have some friction thereby helping to provide retirement income safety.

Action Steps

OK, so you’re convinced. You’re excited by dividend aristocrats. What's next?

Thinking in terms of the "paycheck" (the income your portfolio generates) instead of (or, along with) the "net worth" means that you want to start measuring it too.

And, for people who are a little further from retirement, you want to use income-oriented measures as a way to motivate you to stick to your retirement savings strategy.

The obvious thing to measure is your portfolio income. I like to call this your "Elephant's Paycheck" because we're putting the Elephant in the Room to work, and he's bringing home some bacon.

Less obvious than the paycheck though, and way more exciting (and therefore motivating) is your Elephant's raise. You can measure the raise retroactively, which is eye-opening. A current sample portfolio I’m tracking has experienced a 16% raise over the past 15 months.

Your Elephant's raise has two components, a raise from dividend increases and a raise from dividend reinvestment. Compare this raise to the one you've gotten on your job or your pension or social security, and you understand why it's so eye-opening.

Personally, I enjoy projecting the raise forward. Looking forward, and knowing that I'm going to be getting a double-digit raise over the next 12 months if I just "stick to the plan" really helps me stick to the plan! By the way, the sample portfolio is showing a 12 month projected raise of 13.24% as I write this. I also know, by the way, that's a conservative projection.

In short, if you're going to invest in a portfolio of dividend aristocrats to reduce investment risk, turn on dividend reinvesting. Then, keep track of your Elephant's Paycheck and your Elephant's raises, and investing will become fun again.

My uncle who is retired relies more and more on dividends from his shares

Hi,

I came here through Google search engine and i found some valuable contents about dividends. Now i can clearly understood this things. But i just want to know what is NASDAQ, SENSEX, NIFTY etc. means?

i am waiting for your reply

Thanks