Retirement Investing-The Main Challenge

The long time problem of retirement investing has been the need to have a significant amount of money in equities while avoiding a downturn in the equity markets from destroying your retirement nest egg.Why do you need a significant amount in equities? Because they are the only class of security that has held value and appreciated over 30 years, the likely retirement period for many. The problem is that even if the average retiree devotes a significant portion of their portfolio to equities, they will panic and sell at the wrong time, such as 2008 (5 years later, the market has doubled from those lows). So we need a way to deal with the emotional reactions.

It's paradoxical by the way, but it's the rich guy that can afford to be conservative. With $5 million, he can stick it in the bank at 2% and have $100,00 annual income. But if your nest egg is $1 million, you cannot survive on 2% interest. You are forced to take more risk to get a higher return. So the paradox is that rich people can invest for retirement more conservatively while those with fewer financial resources MUST invest more aggressively if they have any hope of having their retirement savings last. To see the proof of this, please look up the Trinity Study.

By the way--your financial advisor is subject to regulations that will not permit him to do what is best for you. If your resources are modest, he must be more conservative with your funds. In fact, the only way you can make it (i.e. have your retirement funds last for 30 years of retirement), is a retirement investing program that takes sufficient risk to get the return you need.

Retirement Investing Solution

The solution to the problem of equities taking a dive in the middle of your retirement is the bucket strategy. Here's a simplified example of retirement investing using buckets. You divide your funds into 3 buckets: bucket one contains retirement funds to be used over the next 3 years, bucket 2 contains retirement savings to be used 3 to 10 years out and bucket 3 has retirement funds to be used beyond 10 years.

The solution to the problem of equities taking a dive in the middle of your retirement is the bucket strategy. Here's a simplified example of retirement investing using buckets. You divide your funds into 3 buckets: bucket one contains retirement funds to be used over the next 3 years, bucket 2 contains retirement savings to be used 3 to 10 years out and bucket 3 has retirement funds to be used beyond 10 years.

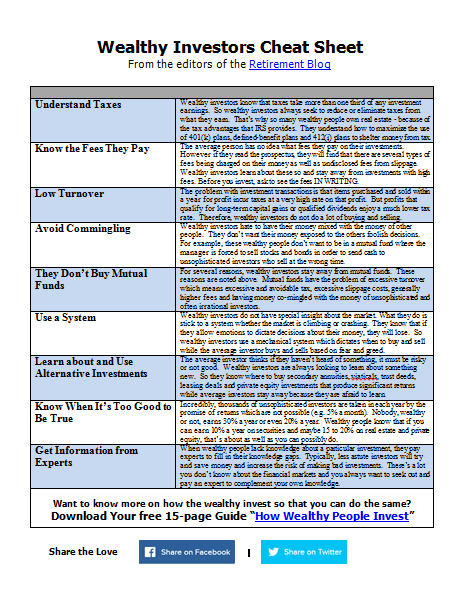

One page "invest like the rich" cheat sheet provides short explanations of how the rich investment differently. You don't need to be rich to copy what they do. Download now.

Stocks in your retirement investing program go into bucket 3 so that you won't be relying on them for 10 years. The historical good news is that stocks have gone up in value in 97% of the 10 year periods since 1926. Of course, the future may not be the same as the past. But since we can see the past and not the future, history suggests that you have put the odds well in your favor if you always invest in stocks (or stock mutual funds) when you can let the funds sit and work for a least 10 years.

This division gives the retiree some comfort as even during a downturn, he know that he does not need to rely on bucket 3 in the near term. So we have increased the odds of sticking with the program and avoiding panic.

Our retirement goal for bucket 3 is to have the money grow at 10% annually (the long term average for stocks) so that each $1 will become $2.59. Should the stock market do extremely well and reach your goal before year 10, you start removing the excess and placing it in fixed income securities to protect the principal. Should the stock market take a dive, you wait out the 10 years as historical probabilities are that the value of bucket 3 recovers by the time you need to rely on it.

You can find this strategy explain in great detail in Paul Grangaard's book, "Grangaard Strategy: Invest Right During Retirement." I have reviewed not just this concept but also the mathematics of this system and it does extremely well over long periods of time to protect capital.

You are right, Retirement Investing The Main Challenge. But you can make loan from bank too.

Very helpfull blog after retirement for safety of life in future

This strategy makes a lot of sense. I have about 10 years before I retire and it sounds like there would still be time for me to approach investing this way. Having lost a near fortune in the stock market I'm still a little leery about stocks.