A long, long time ago, the Internal Revenue Service permitted taxpayers to deduct all their interest costs, even credit card interest - but today, you can solely deduct particular types of interest and can't enjoy a tax shelter as was formerly possible. The most obvious deduction is home mortgage and home equity loan interest. But investment interest expenses also are tax-deductible - and frequently overlooked as a method to enjoy a tax shelter.

When you lend money to purchase taxed investments - for example, when you buy shares on margin - the interest you pay on that loan is called an investment interest cost. You are able to deduct this interest to the extent of your taxable investment income - that is, income from interest and short-term capital gains. If your investment interest cost exceeds your taxable investment income, the surplus interest expense can be carried over to the following tax year. So you not just enjoy a tax shelter this yr but possibly later on.

So why do we say your taxed investment income consists of interest and short-term capital gains, but not mention other evident investment income, including qualified dividends and long-term capital gains? This is where the law gets tricky. In case you want, you might deal with all or part of your qualified returns and long-term capital gains as investment income. This, obviously, will let you possibly deduct more of your investment-interest expense. The problem: The long-term capital gains and certified returns will then be viewed as investment income, and be subject to taxes at your normal tax rate - which may be higher than the 15% tax rate for qualified dividends and long-term capital gains, depending on your tax bracket. So you likely have to see a tax expert to assist enjoy a tax shelter with this strategy. It pays for some but not others.

Also be aware that we mentioned interest on loans used to buy taxable investments is deductible. Interest on financial loans used to purchase non-taxable investments, including municipal bonds or municipal bond resources, is not deductible.(However, if the loan proceeds aren't directly utilized to purchase tax-free bonds however the proceeds free up other funds to purchase tax free securities, it becomes challenging to trace by IRS. Talking to your tax consultant to enjoy a tax shelter using this method is recommended).

Exactly what does this imply? If you have to borrow to purchase investments, it might be considered a great way to enjoy a tax shelter -- to use cash to purchase the non-taxable investments, and used the loan proceeds to purchase the taxable investments.

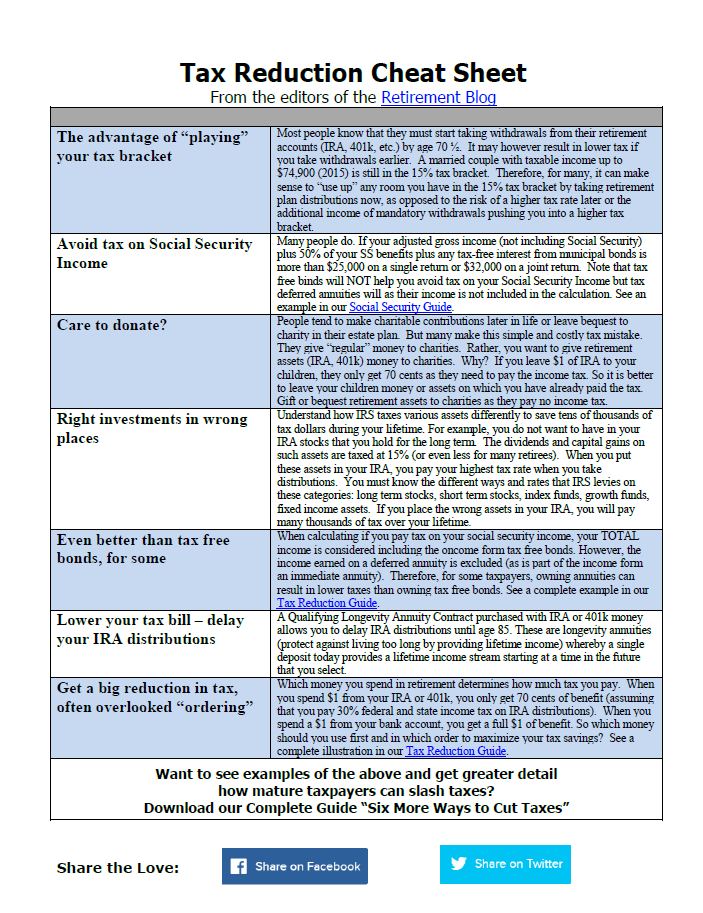

You Pay More Taxes Than Necessary

And we guarantee your CPA has never told you The problem with paying taxes is that most people overpay. So if you are concerned about having enough in retirement, you must stop overpaying taxes. I know you think your CPA takes care of this for you. WRONG. I AM a CPA (retired) and I can tell you that 90% of CPAs do nothing more than enter your information into the little boxes on the tax return but NEVER tell you how to pay less next year. Why? Many of them simply do not know what we can show you. In ten minutes.Get Your Copy Now - 6 Ways to Cut Retirement Taxes

Leave a Reply